TM Brand and info. website and authorized name of Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681 www.brokerit.ca

Newsletters

Retiring? How U.S. Tariffs Could Impact Mortgage Rates Will Impact You

What Do Rising Trade Tensions Mean for Canadian Seniors?

With new U.S. tariffs on Canadian goods already in effect, and Canada imposing retaliatory tariffs on American products, many Canadians—especially retirees and homeowners aged 55+—are concerned about the economic impact. How will these trade disputes affect the cost of living, inflation, and most importantly, mortgage rates for retirees?

For those relying on fixed incomes and home equity to manage expenses, economic uncertainty can feel unsettling. The good news? The Bank of Canada (BoC) is expected to lower interest rates in 2025 to support the economy, which could present an opportunity for homeowners to access more affordable borrowing options.

Rewind Mortgage is here to help retirees navigate these changes, ensuring that home financing remains a tool for financial security and independence in retirement.

Will Mortgage Rates Drop in 2025?

The BoC is expected to lower interest rates throughout 2025, but the exact timeline and depth of the cuts will depend on multiple factors:

Tariffs are slowing the economy – The U.S. tariffs on Canadian goods, coupled with Canada's retaliatory tariffs, are making everything from groceries to construction materials more expensive. A weaker economy often leads to rate cuts to encourage consumer spending and borrowing.

Inflation remains a concern – Higher costs from tariffs could drive inflation up, limiting how aggressively the BoC can cut rates. However, if economic growth slows significantly, the BoC may prioritize rate cuts to prevent a downturn.

Seniors face rising costs – Essential expenses like healthcare, groceries, and utilities could increase due to tariff-driven inflation. If rates drop, retirees may have an opportunity to use home equity strategically—without the pressure of high borrowing costs.

According to MPA Magazine, “Economic uncertainty often prompts central banks to lower rates, but inflationary pressure from trade tariffs could slow this process.”

How Will This Affect Seniors and Retirees?

For homeowners aged 55+, these changes could have both risks and opportunities:

Rising prices could strain fixed incomes – Retirees relying on pensions and savings may find everyday costs rising faster than expected.

Lower mortgage rates could ease financial stress – If rates decline, accessing home equity through a Reverse Mortgage may become a more affordable option.

Investment volatility could increase – Market instability could impact retirement portfolios, making alternative financial strategies, like home equity solutions, more valuable.

What Are Your Home Financing Options?

If rates drop, retirees have several mortgage and home equity options to help maintain financial security.

Rewind Mortgage specializes in helping retirees compare these options to find the best financial strategy.

How Can Retirees Navigate Economic Uncertainty?

While Canada’s economy faces challenges, a full-scale crash is unlikely. Instead, experts predict:

A slowing economy due to tariffs and global uncertainty.

Lower interest rates as the BoC aims to stabilize growth.

Potential home price fluctuations, offering new opportunities for those looking to right-size or access home equity.

For retirees, being proactive about financial planning is the best strategy.

Talk to Rewind Mortgage About Your Options

Understanding how these economic changes affect retirement finances is crucial. If you’re 55+ and want to explore Reverse Mortgages, home equity solutions, or refinancing, Rewind Mortgage can help.

Calculate What You Might Qualify For

What Our Customers are Saying About Us

Marcel L.

Grateful for Peter Fabry and all his help! It's been a lifesaver, supplementing our income and allowing us to travel during retirement. With the rising cost of living, Peter's guidance made the process easy and stress-free. Highly recommended!

Carole & Robert O.

Thanks to Peter Fabry, we upgraded our home with a reverse mortgage, avoiding the need for a care home. Peter's expertise and personalized approach made the process seamless. Highly recommended for seniors seeking financial freedom while aging in place!

James & Cynthia B.

We had an excellent experience working with Peter! He guided us through securing a Home Equity Line of Credit on our mortgage, which turned out to be a better fit for our financial goals. The process was stress-free, and we are relieved to have it sorted out. We highly recommend speaking with Peter for your mortgage needs!

Get In Touch

Address

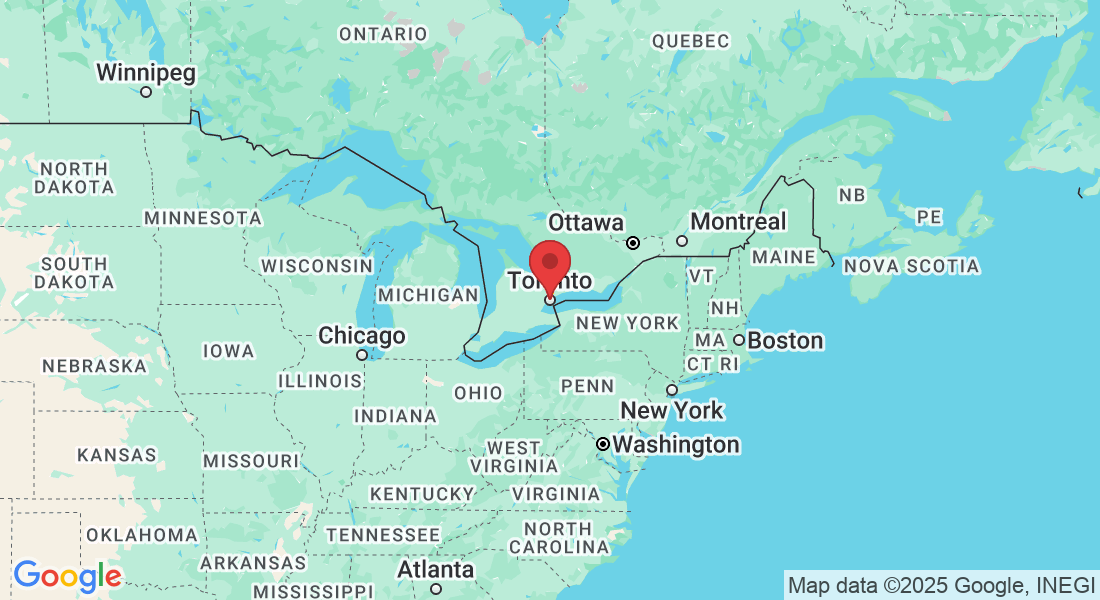

Office: Toronto, Ontario

Email: info@rewindmortgage.ca

Assistance Hours

Mon – Fri 9:00am – 6:00pm

Saturday – By Appointment Only

Sunday – CLOSED

Phone Number:

(289) 312-6333

Sit back, relax, and let us find the best product for you.

Discover the positive impact of reverse mortgages tailored for those who need financial support.

© 2025 Rewind Reverse Mortgages. All Rights Reserved.

.

Rewind Mortgage © All Rights Reserved. Brand, website & social media presence owned and managed by affiliated Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ (ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681) to inform & provide information specific to those 55+. This is an information website. Rewind is not a mortgage brokerage. For mortgage applications & advice you will speak with a licenced Agent/ Underwriter. Restrictions may apply. Subject to credit approval. By submitting your information you consent to us contacting you by text, email, or phone. For more details on how we handle and protect your data, please refer to our full

Privacy Policy

.