TM Brand and info. website and authorized name of Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681 www.brokerit.ca

Newsletters

Choosing the Right Mortgage Strategy in 2026 for Canadian Retirees

Mortgage decisions after 55 require a different strategy. Whether you are restructuring debt, supporting adult children, improving cash flow, or considering a Reverse Mortgage, choosing between fixed,... ...more

Mortgages ,Broker Blogs &Reverse Mortgage

February 15, 2026•3 min read

Rising Buyer Demand in Canada’s 2026 Housing Market

With buyer demand increasing in Canada’s 2026 housing market, homeowners aged 55+ may have more options when it comes to selling, downsizing, or accessing home equity. Here’s how current market trends... ...more

Mortgages ,Broker Blogs &Reverse Mortgage

February 02, 2026•2 min read

How the Bank of Canada’s Rate Pause Affects Retirement Mortgage Planning

With the Bank of Canada holding interest rates steady in 2026, many Canadian retirees are reassessing their mortgage and retirement plans. Learn how a rate pause impacts home equity decisions, renewal... ...more

Mortgages ,Broker Blogs &Reverse Mortgage

January 15, 2026•3 min read

Should I Sell My Home in 2026? A Retirement Planning Question Many Canadian Seniors Are Asking

Many Canadian seniors wonder whether to sell their home before retirement. Learn why timing matters, explore alternatives like Reverse Mortgages and HELOCs, and discover strategies to access home equi... ...more

Mortgages ,Broker Blogs &Reverse Mortgage

January 01, 2026•5 min read

What Are the Best Mortgage Renewal Rates Available in Canada?

If you’re 55 or older and facing a mortgage renewal, the rate your lender offers may not be the only option worth considering. For many retirees and homeowners on fixed incomes, alternatives like a re... ...more

Mortgages ,Broker Blogs &Reverse Mortgage

December 15, 2025•4 min read

Canada’s New Retirement Reality: How Longer Life Expectancy, Rising Costs, and Home Equity Are Reshaping CPP, OAS, and Retirement Planning

Many Canadians are living longer while facing higher retirement costs, making CPP, OAS, and personal savings feel increasingly stretched. Rewind Mortgage helps retirees use their home equity to stabil... ...more

Mortgages ,Broker Blogs &Reverse Mortgage

December 02, 2025•5 min read

Calculate What You Might Qualify For

What Our Customers are Saying About Us

Marcel L.

Grateful for Peter Fabry and all his help! It's been a lifesaver, supplementing our income and allowing us to travel during retirement. With the rising cost of living, Peter's guidance made the process easy and stress-free. Highly recommended!

Carole & Robert O.

Thanks to Peter Fabry, we upgraded our home with a reverse mortgage, avoiding the need for a care home. Peter's expertise and personalized approach made the process seamless. Highly recommended for seniors seeking financial freedom while aging in place!

James & Cynthia B.

We had an excellent experience working with Peter! He guided us through securing a Home Equity Line of Credit on our mortgage, which turned out to be a better fit for our financial goals. The process was stress-free, and we are relieved to have it sorted out. We highly recommend speaking with Peter for your mortgage needs!

Get In Touch

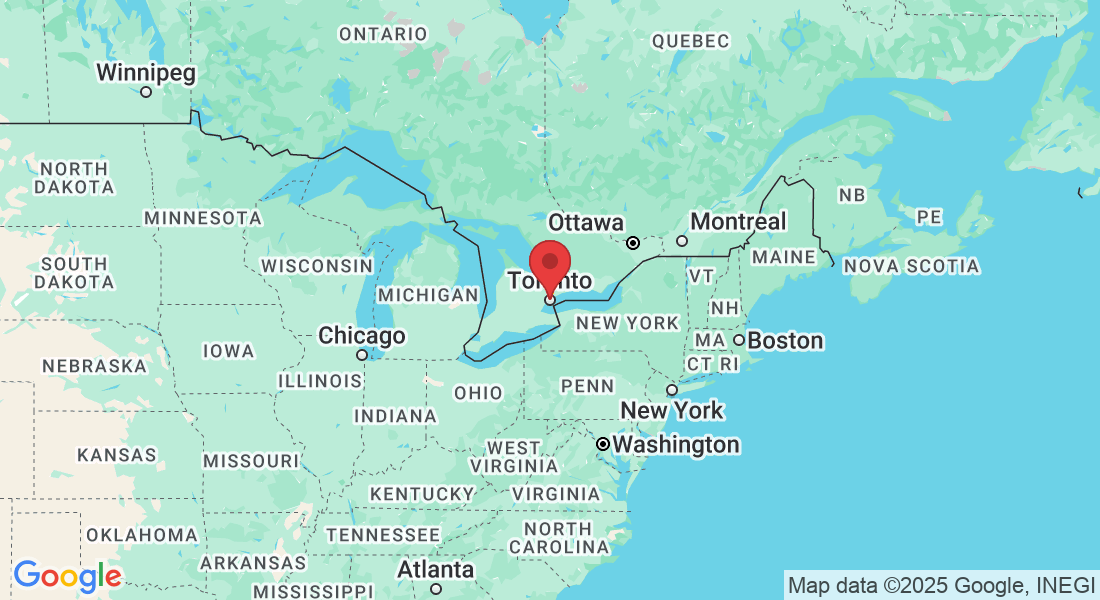

Address

Office: Toronto, Ontario

Email: info@rewindmortgage.ca

Assistance Hours

Mon – Fri 9:00am – 6:00pm

Saturday – By Appointment Only

Sunday – CLOSED

Phone Number:

(289) 312-6333

Sit back, relax, and let us find the best product for you.

Discover the positive impact of reverse mortgages tailored for those who need financial support.

For information on alternatives to reverse mortgages visit www.brokerit.ca

© 2026 Rewind Reverse Mortgages. All Rights Reserved.

.

Rewind Mortgage © All Rights Reserved. Brand, website & social media presence owned and managed by affiliated Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ (ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681) to inform & provide information specific to those 55+. This is an information website. Rewind is not a mortgage brokerage. For mortgage applications & advice you will speak with a licenced Agent/ Underwriter. Restrictions may apply. Subject to credit approval. By submitting your information you consent to us contacting you by text, email, or phone. For more details on how we handle and protect your data, please refer to our full

Privacy Policy

.