TM Brand and info. website and authorized name of Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681 www.brokerit.ca

Newsletters

How Today’s Economy Is Impacting Mortgages—and What That Means for Retirees in 2025

Rewind Mortgage Explains the Options for Canadians Navigating Higher Costs and Renewals

Millions of Canadians will face a major financial decision in 2025 as their mortgages come up for renewal—many for the first time since rates fell to record lows during the pandemic. Now, interest rates are two to three times higher, and that sudden jump is causing real concern for older homeowners, especially those on a fixed income, nearing or already in retirement.

At the same time, economic uncertainty—from rising global tensions to weakening consumer confidence—is adding pressure to everyday finances. But here’s the good news: there are ways to navigate this market without selling your home or compromising your independence.

Rewind Mortgage, led by Reverse Mortgage specialist Peter Fabry, is helping Canadians 55 and older access the value in their homes safely and strategically.

A Unique Moment in Canada’s Economic Cycle

Recent headlines have been filled with talk of a looming recession, higher tariffs, and a decline in confidence across the Canadian economy. As CBC reports, “a perfect storm of global trade issues and weak consumer data is threatening the stability of major economies” (CBC).

Closer to home, economist David Rosenberg told CTV News, “We are already seeing recessionary patterns in Canada” with slowing growth and rising financial strain on families (CTV).

For Canadians over 55, this is more than just economic theory—it’s showing up as real concerns about:

Managing mortgage payments on a fixed income

Whether to renew at a much higher rate

Whether downsizing is necessary

How to support adult children or aging spouses in the same household

Peter Fabry understands these challenges deeply and works with each family to understand the best path forward based on their needs—not just financial products.

Why Reverse Mortgages Are Being Reconsidered in 2025

Reverse Mortgages have long been misunderstood in Canada. But in today’s climate, more Canadians are taking a second look at how they can help preserve stability and independence—especially when renewing at higher interest rates could cause monthly payments to spike.

With a Reverse Mortgage, homeowners aged 55+ can:

Access a portion of their home equity

Eliminate monthly mortgage payments

Retain full ownership of their home

Free up cash to cover rising living costs or support family

Avoid tapping into RRSPs or investments at a loss

These solutions can be especially powerful for those facing a mortgage renewal with limited income flexibility.

As Canadian Mortgage Trends noted in April 2025, “Consumer confidence is at its lowest since 2020, driven in part by concerns over debt affordability and housing costs.” That makes this a crucial time to rethink traditional solutions—and to explore new ones with trusted guidance.

When a Reverse Mortgage Can Make Sense

Rewind Mortgage typically helps clients in situations such as:

“The goal isn’t to sell you on one product—it’s to make sure you understand all your options and feel confident about your decision.”

— Peter Fabry, Rewind Mortgage

Family Conversations Matter

Peter encourages families to talk openly about these decisions. Adult children often play a key role in helping parents evaluate their financial options—and it’s important they understand that Reverse Mortgages aren’t about giving up the home or leaving less behind.

In many cases, rising home values continue to offset the interest accrued on a Reverse Mortgage, helping preserve equity over time. And since there are no required monthly payments, homeowners avoid the strain that traditional renewals may bring.

Trusted, Professional Guidance Every Step of the Way

What makes Rewind Mortgage unique is Peter’s deep experience and client-focused approach. He takes the time to explain all the details clearly, and works closely with each client’s accountant, lawyer, or financial advisor to ensure every aspect is covered.

Clients receive personalized support—not just paperwork—and can explore options like:

Reverse Mortgages

Refinancing

HELOCs (Home Equity Lines of Credit)

Traditional mortgage renewals or extensions

Peter believes no one should feel pressured to make a fast decision, especially at a time when many are already feeling anxious about their finances.

Ready to Talk About Your Options?

Whether you’re renewing your mortgage or simply want to understand what’s available, reach out to Rewind Mortgage to schedule a confidential conversation.

Contact Peter Fabry today at 289-312-6333 or info@rewindmortgage.ca

Calculate What You Might Qualify For

What Our Customers are Saying About Us

Marcel L.

Grateful for Peter Fabry and all his help! It's been a lifesaver, supplementing our income and allowing us to travel during retirement. With the rising cost of living, Peter's guidance made the process easy and stress-free. Highly recommended!

Carole & Robert O.

Thanks to Peter Fabry, we upgraded our home with a reverse mortgage, avoiding the need for a care home. Peter's expertise and personalized approach made the process seamless. Highly recommended for seniors seeking financial freedom while aging in place!

James & Cynthia B.

We had an excellent experience working with Peter! He guided us through securing a Home Equity Line of Credit on our mortgage, which turned out to be a better fit for our financial goals. The process was stress-free, and we are relieved to have it sorted out. We highly recommend speaking with Peter for your mortgage needs!

Get In Touch

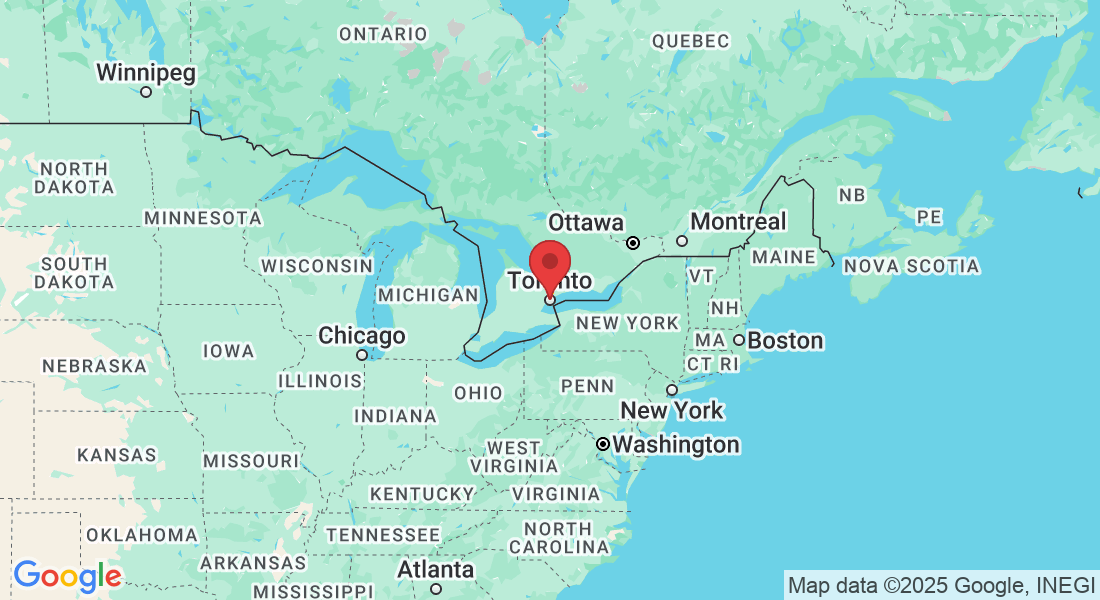

Address

Office: Toronto, Ontario

Email: info@rewindmortgage.ca

Assistance Hours

Mon – Fri 9:00am – 6:00pm

Saturday – By Appointment Only

Sunday – CLOSED

Phone Number:

(289) 312-6333

Sit back, relax, and let us find the best product for you.

Discover the positive impact of reverse mortgages tailored for those who need financial support.

© 2025 Rewind Reverse Mortgages. All Rights Reserved.

.

Rewind Mortgage © All Rights Reserved. Brand, website & social media presence owned and managed by affiliated Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ (ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681) to inform & provide information specific to those 55+. This is an information website. Rewind is not a mortgage brokerage. For mortgage applications & advice you will speak with a licenced Agent/ Underwriter. Restrictions may apply. Subject to credit approval. By submitting your information you consent to us contacting you by text, email, or phone. For more details on how we handle and protect your data, please refer to our full

Privacy Policy

.