TM Brand and info. website and authorized name of Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681 www.brokerit.ca

Newsletters

Renew or Refinance? What Canadian Homeowners Aged 55+ Need to Know

Renew or Refinance? What Canadian Homeowners Aged 55+ Need to Know

For many Canadians aged 55 and older, approaching the end of a mortgage term brings an important financial decision: Should you renew your mortgage as-is or explore refinancing for more flexibility? With interest rates on the rise and home equity growing, choosing the right option can help you maintain financial security in retirement.

Mortgage Renewal – A Simple Option

If your mortgage term is ending, renewing means agreeing to a new term (usually 1 to 5 years) with your existing lender. The balance and amortization period stay the same, but your interest rate and monthly payment may change based on current rates.

Example:

A homeowner who borrowed $400,000 in 2020 at 1.70% interest would have a remaining balance of about $332,939.71 after five years. At renewal, they would need to negotiate a new interest rate, likely higher than their original rate.

Pros of Renewing:

✔ Quick and easy process with no extra paperwork

✔ No additional debt added

✔ Possible rate negotiation with your lender

Cons of Renewing:

✖ Could lead to “payment shock” if rates have increased

✖ No ability to access home equity for other financial needs

Mortgage Refinancing – A Flexible Alternative

Refinancing allows homeowners to restructure their mortgage. This can mean:

Extending the amortization to reduce monthly payments

Accessing home equity for financial needs

Consolidating higher-interest debt into a lower-rate mortgage

Example:

If a homeowner’s property has increased in value, refinancing could provide access to built-up equity. This extra cash could be used for renovations, medical expenses, investments, or supplementing retirement income.

Pros of Refinancing:

✔ Helps manage higher mortgage payments by extending amortization

✔ Allows homeowners to access tax-free cash from home equity

✔ Provides financial flexibility without selling the home

Cons of Refinancing:

✖ May include prepayment penalties if done before term-end

✖ Extending amortization increases total interest paid over time

How Interest Rates Impact Your Decision

Homeowners who locked in a 1.70% fixed rate five years ago may now face renewal rates of 4.50% or higher. That can cause a sharp increase in monthly payments, creating financial strain—especially for retirees on a fixed income.

One way to manage this increase is by refinancing with a longer amortization to reduce monthly payments. Here’s a comparison:

Rates are for illustrative purposes only. Rates subject to change without notice. OAC, E&O.

By refinancing, homeowners can lower their monthly payments, making it easier to manage expenses in retirement.

Could a Reverse Mortgage Be a Better Option?

For homeowners 55 and older, a Reverse Mortgage offers another way to access home equity without increasing monthly debt payments. Unlike traditional refinancing, a Reverse Mortgage:

✔ Provides tax-free cash without requiring monthly mortgage payments

✔ Allows homeowners to stay in their home while using their equity

✔ Can be used for any purpose, including covering living expenses, medical costs, or helping family members

If maintaining cash flow is a priority, Rewind Mortgage can help determine whether a Reverse Mortgage is the right alternative to refinancing.

Key Terms Explained

Amortization Period

The total time it takes to pay off a mortgage. Extending this period lowers monthly payments but increases long-term interest costs.

Home Equity

The portion of a home that is owned outright, calculated as:

Home Value – Mortgage Balance = Equity

With a traditional mortgage, you can refinance up to 80% of the home’s value, as long as you qualify based on your income and existing debts. With a Reverse Mortgage, qualification is less about income and more about age, the location of the home, and having at least 50% equity or more. You can then pull out tax-free cash with no required payments through a Reverse Mortgage. Don’t forget that your home continues to appreciate over time.

Payment Shock

A sudden increase in mortgage payments due to higher interest rates at renewal. Retirees on a fixed income can reduce this risk by refinancing or considering a Reverse Mortgage.

What’s the Best Option for You?

Every homeowner’s financial situation is different. If you’re facing mortgage renewal and are unsure whether to renew, refinance, or explore a Reverse Mortgage, Rewind Mortgage can help.

We specialize in helping Canadians 55+ navigate their mortgage options with clarity and confidence. Contact us today to explore the best strategy for your financial future.

📞 Call Rewind Mortgage at 289-312-6333

📧 Email Peter Fabry at info@rewindmortgage.ca

Calculate What You Might Qualify For

What Our Customers are Saying About Us

Marcel L.

Grateful for Peter Fabry and all his help! It's been a lifesaver, supplementing our income and allowing us to travel during retirement. With the rising cost of living, Peter's guidance made the process easy and stress-free. Highly recommended!

Carole & Robert O.

Thanks to Peter Fabry, we upgraded our home with a reverse mortgage, avoiding the need for a care home. Peter's expertise and personalized approach made the process seamless. Highly recommended for seniors seeking financial freedom while aging in place!

James & Cynthia B.

We had an excellent experience working with Peter! He guided us through securing a Home Equity Line of Credit on our mortgage, which turned out to be a better fit for our financial goals. The process was stress-free, and we are relieved to have it sorted out. We highly recommend speaking with Peter for your mortgage needs!

Get In Touch

Address

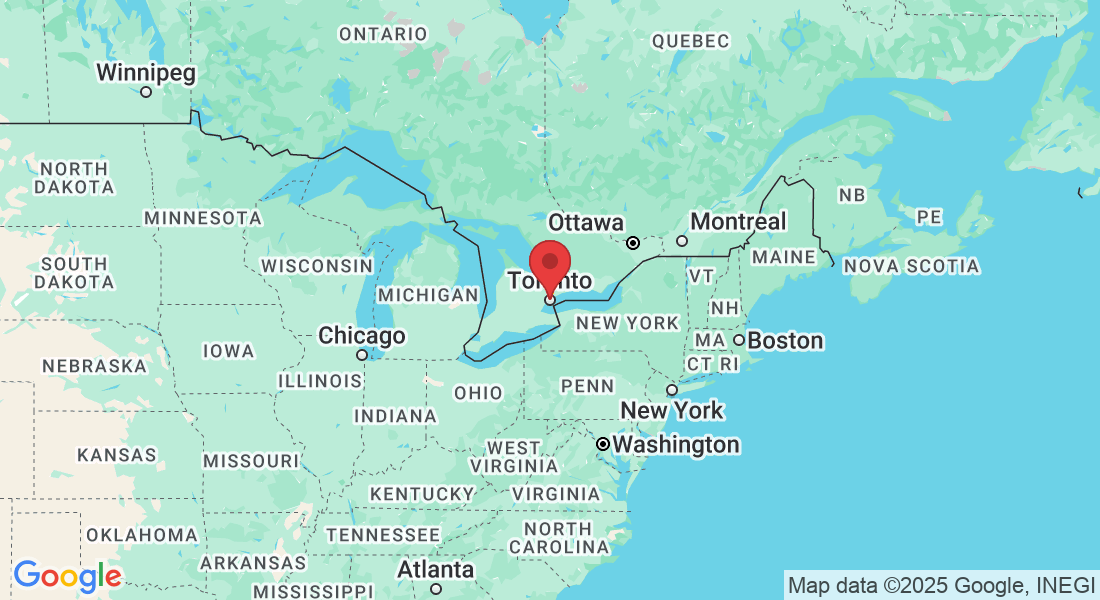

Office: Toronto, Ontario

Email: info@rewindmortgage.ca

Assistance Hours

Mon – Fri 9:00am – 6:00pm

Saturday – By Appointment Only

Sunday – CLOSED

Phone Number:

(289) 312-6333

Sit back, relax, and let us find the best product for you.

Discover the positive impact of reverse mortgages tailored for those who need financial support.

© 2025 Rewind Reverse Mortgages. All Rights Reserved.

.

Rewind Mortgage © All Rights Reserved. Brand, website & social media presence owned and managed by affiliated Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ (ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681) to inform & provide information specific to those 55+. This is an information website. Rewind is not a mortgage brokerage. For mortgage applications & advice you will speak with a licenced Agent/ Underwriter. Restrictions may apply. Subject to credit approval. By submitting your information you consent to us contacting you by text, email, or phone. For more details on how we handle and protect your data, please refer to our full

Privacy Policy

.