TM Brand and info. website and authorized name of Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681 www.brokerit.ca

Newsletters

Your Home Can Fund Independence in Retirement—Without Selling It

For many Canadians nearing retirement, the goal has always been clear: own your home outright and live mortgage-free. But today, financial stability and independence often require more flexibility than that traditional model provides.

Rewind Mortgage understands that retirement isn’t just about staying afloat—it’s about living well, maintaining independence, and preserving the comfort of home. In many cases, that means thinking differently about the equity built up in your house.

Reverse Mortgages are one increasingly popular option that helps Canadians 55+ tap into that equity while continuing to own and live in their homes—with no regular mortgage payments required. Peter Fabry and the Rewind Mortgage team specialize in helping families understand when a Reverse Mortgage makes sense, and how it compares to other financial tools.

Your Home Is a Powerful Asset—Especially in Retirement

According to Mortgage Professionals Canada, most homeowners now have more than 25% equity in their homes. That represents significant untapped value—value that could be used to:

Supplement a fixed retirement income

Pay for home upgrades or in-home care

Cover rising medical or living expenses

Support adult children or grandchildren

Avoid drawing down RRSPs or investment accounts too early

What makes a Reverse Mortgage different is that you don’t have to sell your home or make monthly payments. The loan is repaid only when you move or sell.

And because home values in most parts of Canada continue to appreciate—often at the same pace or faster than the interest accrued on a Reverse Mortgage—you’re preserving long-term value while increasing short-term comfort.

Why More Canadians Are Choosing to Age in Place

One of the key concerns for aging Canadians is the rising cost and limited availability of long-term care.

In Ontario alone:

Half of applicants wait more than 6 months for long-term care placement

Some individuals face wait times of up to 2.5 years

There are only 615 licensed long-term care homes across the province, according to the Ontario Long-Term Care Association

For many, this creates a challenging situation: they want to remain in their homes longer, but they need financial support to make it possible. A Reverse Mortgage can help fund:

Home modifications for safety and accessibility

Part-time or full-time in-home caregivers

Meal prep, transportation, or cleaning services

Private care while waiting for a long-term care placement

Peter Fabry and the Rewind Mortgage team are often contacted by adult children concerned about their parents' financial well-being. In many cases, a Reverse Mortgage can relieve the pressure on both generations—helping older Canadians remain independent while preserving family resources.

What a Reverse Mortgage Is (and Isn’t)

There are still a few common misconceptions about Reverse Mortgages. Let’s clarify the facts:

You remain the owner of your home. You are not signing it over to a lender.

There are no regular payments required. You don’t pay monthly principal or interest.

You can never owe more than your home is worth. Thanks to Canada’s federally regulated Reverse Mortgage guidelines, your estate is protected.

In short, a Reverse Mortgage is not about giving up ownership—it’s about using your home to support your lifestyle and care needs, while still living in it.

When Might a Reverse Mortgage Make Sense?

The Rewind Approach: Personalized, Family-Centered Advice

At Rewind Mortgage, Peter Fabry works closely with homeowners and their families to ensure the decision to use a Reverse Mortgage is well-informed and aligned with their long-term goals.

That includes:

Educating both parents and adult children

Reviewing other financial options side-by-side (including refinancing, HELOCs, and downsizing)

Ensuring full transparency on rates, costs, and impact on the estate

Connecting clients with financial advisors, estate planners, and lawyers as needed

This collaborative, no-pressure approach has helped hundreds of Canadians feel empowered—not overwhelmed—when deciding how to manage their equity.

The Bottom Line: Retirement Isn’t One-Size-Fits-All

Not everyone will need a Reverse Mortgage. But for those who do, it can provide security, dignity, and peace of mind—without sacrificing the home and lifestyle they’ve worked hard to build.

With increasing life expectancy, rising healthcare costs, and long-term care waitlists growing, flexibility is more important than ever in retirement planning. Your home can be part of the solution.

Want to explore whether a Reverse Mortgage could support your retirement goals?

Talk to Peter Fabry and the team at Rewind Mortgage for clear answers and compassionate advice.

Sources:

Statistics Canada – Household balance sheet, national balance sheet and financial flow accounts

https://www150.statcan.gc.ca/n1/daily-quotidien/250305/dq250305a-eng.htmGovernment of Canada – General Information on Long-Term Care

https://srv111.services.gc.ca/generalinfo/indexStatistics Canada – Average Home Equity Data (Table: 14-10-0060-01)

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1410006001RateSpy – What Will Canadians Do With All Their New Equity?

https://www.ratespy.com/what-will-canadians-do-with-all-their-new-equity-072219109#:~:text=Using%20Mortgage%20Professionals%20Canada%20data,now%20have%20over%2025%25%20equity.WOWA – Canada Housing Market Report

https://wowa.ca/reports/canada-housing-marketFisher Investments – Definitive Guide to Retirement Income

https://www.fisherinvestments.com/en-ca/campaigns/definitive-guide-to-retirement-income/1mMorningstar Canada – How to Use Your Home as a Retirement Asset in Canada

https://www.morningstar.ca/ca/news/248172/how-to-use-your-home-as-a-retirement-asset-in-canada.aspxOLTCA - The Data: Long-Term Care in Ontario

https://www.oltca.com/about-long-term-care/the-data/#:~:text=Half%20of%20Ontarians%20wait%20at,waiting%20up%20to%202.5%20years.&text=There%20are%20615%20licensed%20homes%20operating%20across%20Ontario%20providing%20care%20to%20residents.

Calculate What You Might Qualify For

What Our Customers are Saying About Us

Marcel L.

Grateful for Peter Fabry and all his help! It's been a lifesaver, supplementing our income and allowing us to travel during retirement. With the rising cost of living, Peter's guidance made the process easy and stress-free. Highly recommended!

Carole & Robert O.

Thanks to Peter Fabry, we upgraded our home with a reverse mortgage, avoiding the need for a care home. Peter's expertise and personalized approach made the process seamless. Highly recommended for seniors seeking financial freedom while aging in place!

James & Cynthia B.

We had an excellent experience working with Peter! He guided us through securing a Home Equity Line of Credit on our mortgage, which turned out to be a better fit for our financial goals. The process was stress-free, and we are relieved to have it sorted out. We highly recommend speaking with Peter for your mortgage needs!

Get In Touch

Address

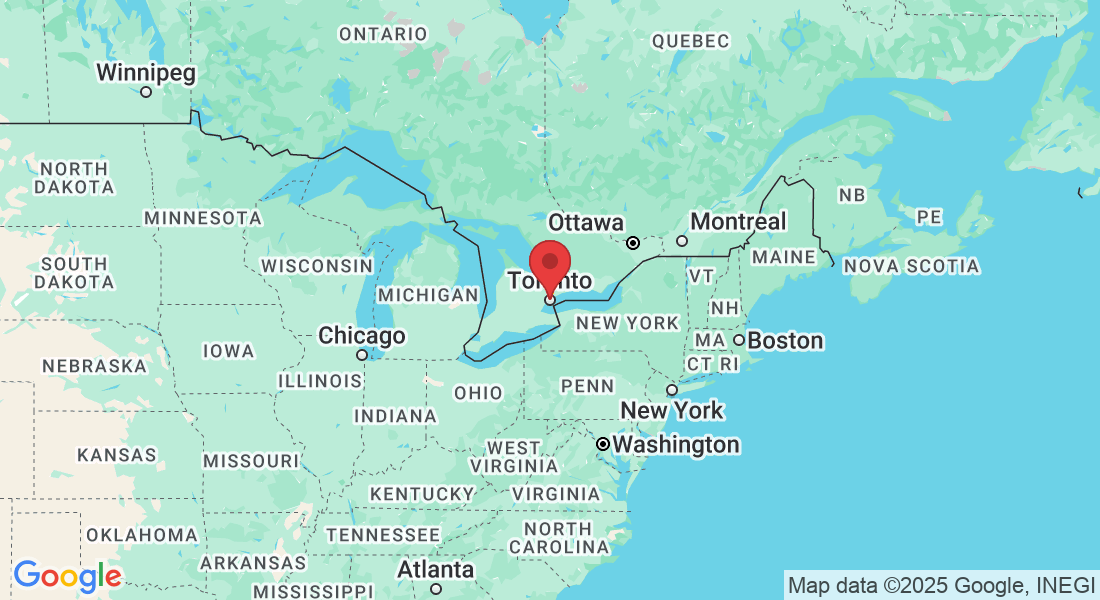

Office: Toronto, Ontario

Email: info@rewindmortgage.ca

Assistance Hours

Mon – Fri 9:00am – 6:00pm

Saturday – By Appointment Only

Sunday – CLOSED

Phone Number:

(289) 312-6333

Sit back, relax, and let us find the best product for you.

Discover the positive impact of reverse mortgages tailored for those who need financial support.

For information on alternatives to reverse mortgages visit www.brokerit.ca

© 2025 Rewind Reverse Mortgages. All Rights Reserved.

.

Rewind Mortgage © All Rights Reserved. Brand, website & social media presence owned and managed by affiliated Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ (ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681) to inform & provide information specific to those 55+. This is an information website. Rewind is not a mortgage brokerage. For mortgage applications & advice you will speak with a licenced Agent/ Underwriter. Restrictions may apply. Subject to credit approval. By submitting your information you consent to us contacting you by text, email, or phone. For more details on how we handle and protect your data, please refer to our full

Privacy Policy

.