TM Brand and info. website and authorized name of Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681 www.brokerit.ca

Newsletters

Why Careful Guidance and Document Review Still Matter—Even for Reverse Mortgages

Think You’re Approved? Not So Fast—Here’s What Most People Miss

Why Careful Guidance and Document Review Still Matter—Even for Reverse Mortgages

Many Canadians aged 55 and up are exploring ways to make the most of their home equity in retirement. Whether it’s through a Reverse Mortgage, a line of credit, or a traditional refinance, one of the first steps is often a pre-approval. But here’s something most people—and even some professionals—don’t talk about: not all pre-approvals are reliable. In fact, some can give homeowners a false sense of security.

At Rewind Mortgage, Peter Fabry has seen it time and time again—someone is told they’re “pre-approved,” but when it’s time to move forward, the deal unravels. Why? Because the information was never fully reviewed in the first place.

Why Pre-Approvals Fall Apart

In the traditional mortgage world, pre-approvals are often based on unverified details: estimated income, rough credit assumptions, and general debt levels. The lender only does a full review after an offer is accepted or a live application is submitted. That’s when issues surface—and when a client may hear “you’re no longer approved.”

Even the property itself can be a factor. If a home has structural concerns, zoning issues, or is in a location a lender isn’t comfortable with, they may decline the application—even if the homeowner qualifies.

Reverse Mortgages: Less Paperwork, Still Worth Reviewing Carefully

Reverse Mortgages are different. In many cases, they require very little documentation—no income verification, no credit score minimums, and no stress testing. That simplicity is one of the reasons they’re so attractive for Canadians over 55.

But Peter Fabry takes things a step further.

Even though most lenders don’t require full documentation for a Reverse Mortgage, Peter may still ask for certain details—like tax returns, account statements, or information about debts. Not to make the process harder, but to make it clearer.

Why? Because what if there’s a better option?

What if, after reviewing your information, Peter sees that a Home Equity Line of Credit (HELOC) or traditional mortgage could work better for your goals?

Without looking at the full picture, there’s no way to give you an honest comparison. That’s why Peter goes deeper. It’s not about selling one product—it’s about ensuring you understand every available option so you can choose what’s right for you and your family.

It’s Not Just About You—It’s About Those Who Support You

Financial decisions in retirement often involve more than one person. That’s why Peter encourages involving adult children, caregivers, or trusted professionals. At Rewind Mortgage, the approach is collaborative—Peter frequently works alongside accountants, financial planners, and lawyers to give clients a full view of their situation.

Mortgage solutions in retirement are never one-size-fits-all. Your health, your home, your estate plans—all of it matters. And you deserve advice that respects the full picture.

A rushed or incomplete pre-approval can create stress and disappointment.

A proper review creates confidence.

Ready to Understand What You Actually Qualify For?

If you’ve been told you’re pre-approved, but no one asked for documents or explained all your options, it’s worth having a second look. At Rewind Mortgage, Peter Fabry offers calm, caring guidance to ensure you’re on solid footing—no assumptions, no surprises.

Contact Peter Fabry today at 289-312-6333 or info@rewindmortgage.ca

Whether you're considering a Reverse Mortgage or exploring other equity options, Rewind Mortgage is here to help you move forward with clarity.

Calculate What You Might Qualify For

What Our Customers are Saying About Us

Marcel L.

Grateful for Peter Fabry and all his help! It's been a lifesaver, supplementing our income and allowing us to travel during retirement. With the rising cost of living, Peter's guidance made the process easy and stress-free. Highly recommended!

Carole & Robert O.

Thanks to Peter Fabry, we upgraded our home with a reverse mortgage, avoiding the need for a care home. Peter's expertise and personalized approach made the process seamless. Highly recommended for seniors seeking financial freedom while aging in place!

James & Cynthia B.

We had an excellent experience working with Peter! He guided us through securing a Home Equity Line of Credit on our mortgage, which turned out to be a better fit for our financial goals. The process was stress-free, and we are relieved to have it sorted out. We highly recommend speaking with Peter for your mortgage needs!

Get In Touch

Address

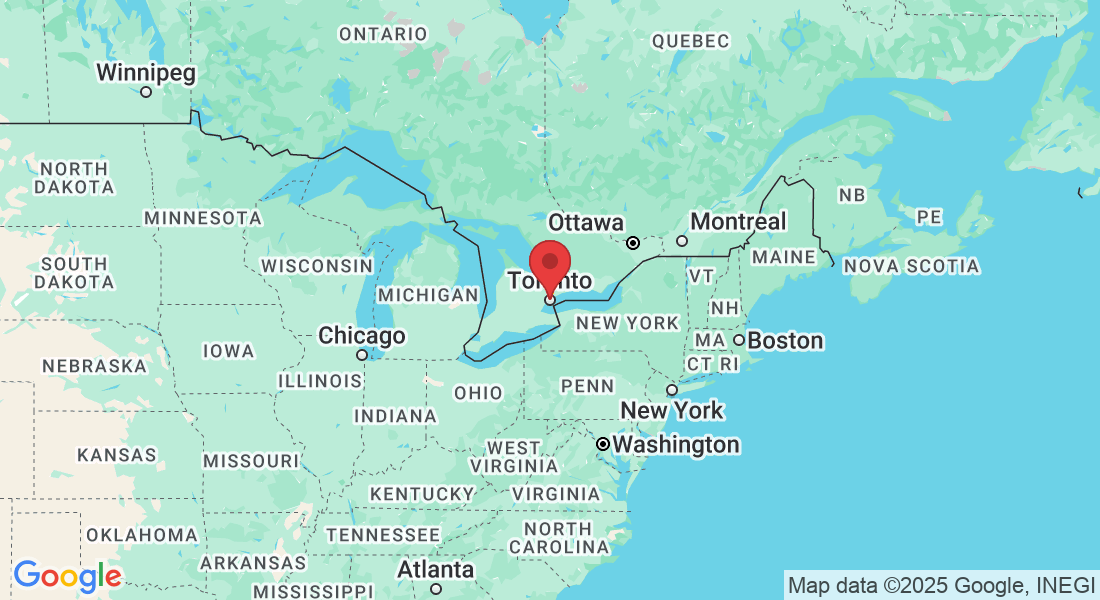

Office: Toronto, Ontario

Email: info@rewindmortgage.ca

Assistance Hours

Mon – Fri 9:00am – 6:00pm

Saturday – By Appointment Only

Sunday – CLOSED

Phone Number:

(289) 312-6333

Sit back, relax, and let us find the best product for you.

Discover the positive impact of reverse mortgages tailored for those who need financial support.

For information on alternatives to reverse mortgages visit www.brokerit.ca

© 2025 Rewind Reverse Mortgages. All Rights Reserved.

.

Rewind Mortgage © All Rights Reserved. Brand, website & social media presence owned and managed by affiliated Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ (ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681) to inform & provide information specific to those 55+. This is an information website. Rewind is not a mortgage brokerage. For mortgage applications & advice you will speak with a licenced Agent/ Underwriter. Restrictions may apply. Subject to credit approval. By submitting your information you consent to us contacting you by text, email, or phone. For more details on how we handle and protect your data, please refer to our full

Privacy Policy

.