TM Brand and info. website and authorized name of Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681 www.brokerit.ca

Newsletters

Reverse Mortgages in Canada: Fact vs Fiction for Today’s Retirees

When Peter Fabry at Rewind Mortgage meets with seniors and their families, one concern comes up again and again: “We don’t want to lose our home.” Many Canadians think a reverse mortgage means handing over their house to the bank, but that’s one of the biggest myths out there.

The reality? A reverse mortgage can be a safe, flexible way to turn your home equity into tax-free cash flow while keeping ownership of your home. Let’s explore what’s true, what’s not, and how it might fit into your retirement plan.

What a reverse mortgage really is

A reverse mortgage is a loan designed for Canadians 55 and older that lets you access a portion of your home equity, up to 55% in many cases without selling your home or making monthly payments.

Unlike a traditional mortgage where you pay the bank, a reverse mortgage pays you. The loan balance (principal + interest) is repaid only when you sell your home, move, or pass away.

This means you can stay in your home, enjoy the equity you’ve built, and relieve financial stress without the burden of monthly payments.

Common myths about reverse mortgages

Myth #1: “I’ll lose my home.”

Fact: You keep full ownership. As long as you live in the home, maintain it, and pay property taxes and insurance, the home remains yours.

Myth #2: “The bank will take all my equity.”

Fact: Canadian reverse mortgages are designed so you’ll never owe more than the fair market value of your home. Most people still retain significant equity when the loan is eventually repaid.

Myth #3: “It’s only for people who are desperate.”

Fact: Many retirees use reverse mortgages strategically - to renovate, cover healthcare costs, invest, or help children with a down payment. It’s a tool for flexibility, not just emergencies.

Why more Canadians are considering them now

Rising cost of living: Groceries, utilities, and medical expenses are eating into fixed pensions.

Longer retirements: Canadians are living longer. That’s good news, but it means retirement savings need to stretch further.

Supporting family: Many seniors want to help adult children with homeownership or education - a “living inheritance.”

Avoiding downsizing: A reverse mortgage lets you stay in your community and home longer without selling.

Real story: How one couple made it work

Janet and Robert, both in their 70s, wanted to stay in the home they had lived in for over 40 years. Their pensions covered basics, but unexpected medical bills created stress.

They took out a reverse mortgage that gave them access to $150,000 of their home’s equity. With that, they:

Paid off lingering debts,

Renovated their bathroom to be more accessible, and

Set aside funds for future healthcare needs.

Most importantly, they kept living in the home they loved, with peace of mind.

Is a reverse mortgage right for you?

It depends on your goals. A reverse mortgage can be a smart option if:

You want to stay in your home as long as possible.

You have significant home equity but limited monthly cash flow.

You want to reduce financial stress without selling.

You’d like to provide financial support to children or grandchildren.

It may not be the best choice if:

You plan to move in the near future.

You’re concerned about leaving the maximum possible inheritance.

The bottom line

Reverse mortgages aren’t for everyone - but for many Canadian seniors, they can provide security, independence, and dignity in retirement. At Rewind Mortgage, Peter Fabry takes the time to walk seniors and their families through the details, so everyone feels informed and comfortable.

If you’d like to explore whether a reverse mortgage could fit your retirement plans, we’d be happy to review your options with you.

Your home is more than where you live, it’s a financial resource that can help you enjoy retirement on your terms.

📞 Call (289) 312-6333

📧 [email protected]

🌐 rewindmortgage.ca

Rewind Mortgage is here to help you make informed, confident choices…because financial peace of mind should be part of every retirement plan.

Rewind Mortgage is dedicated to seniors’ financial independence. Under Peter Fabry’s leadership, we blend empathetic service with creative mortgage solutions to help you enjoy life on your terms.

Calculate What You Might Qualify For

What Our Customers are Saying About Us

Marcel L.

Grateful for Peter Fabry and all his help! It's been a lifesaver, supplementing our income and allowing us to travel during retirement. With the rising cost of living, Peter's guidance made the process easy and stress-free. Highly recommended!

Carole & Robert O.

Thanks to Peter Fabry, we upgraded our home with a reverse mortgage, avoiding the need for a care home. Peter's expertise and personalized approach made the process seamless. Highly recommended for seniors seeking financial freedom while aging in place!

James & Cynthia B.

We had an excellent experience working with Peter! He guided us through securing a Home Equity Line of Credit on our mortgage, which turned out to be a better fit for our financial goals. The process was stress-free, and we are relieved to have it sorted out. We highly recommend speaking with Peter for your mortgage needs!

Get In Touch

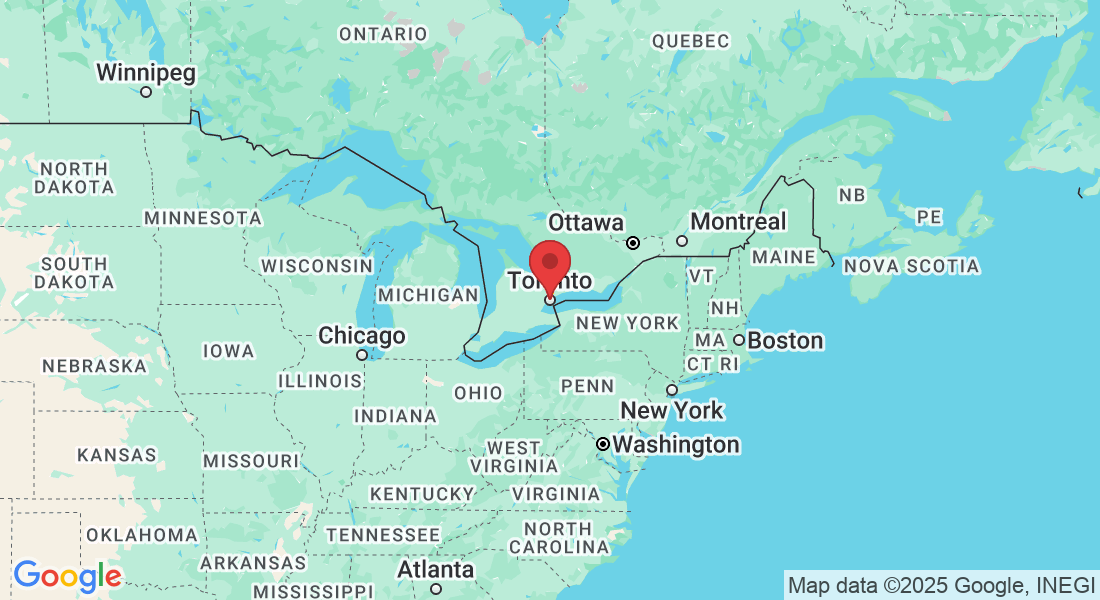

Address

Office: Toronto, Ontario

Email: info@rewindmortgage.ca

Assistance Hours

Mon – Fri 9:00am – 6:00pm

Saturday – By Appointment Only

Sunday – CLOSED

Phone Number:

(289) 312-6333

Sit back, relax, and let us find the best product for you.

Discover the positive impact of reverse mortgages tailored for those who need financial support.

For information on alternatives to reverse mortgages visit www.brokerit.ca

© 2025 Rewind Reverse Mortgages. All Rights Reserved.

.

Rewind Mortgage © All Rights Reserved. Brand, website & social media presence owned and managed by affiliated Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ (ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681) to inform & provide information specific to those 55+. This is an information website. Rewind is not a mortgage brokerage. For mortgage applications & advice you will speak with a licenced Agent/ Underwriter. Restrictions may apply. Subject to credit approval. By submitting your information you consent to us contacting you by text, email, or phone. For more details on how we handle and protect your data, please refer to our full

Privacy Policy

.