TM Brand and info. website and authorized name of Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681 www.brokerit.ca

Newsletters

No-Payment Mortgages: A Flexible Option for Canadian Homeowners 55+

For many Canadians over 55, home equity is their largest financial asset. Yet, many feel cash-strapped, worried about covering rising living costs, healthcare, or helping family members financially. Selling isn’t always the best choice, especially if home values continue to rise.

A no-payment mortgage, also known as a reverse mortgage, allows homeowners to access their home’s equity without monthly payments—giving them financial flexibility while staying in their home. Despite misconceptions, reverse mortgages in Canada are designed to be conservative, secure, and sustainable.

Why a No-Payment Mortgage May Make Sense for You

A common concern about reverse mortgages is that interest accrues over time. However, what many don’t realize is that real estate appreciation often offsets borrowing costs.

For example:

Most Canadian homeowners have seen their property values increase year over year, meaning their equity remains intact, even after years of borrowing.

A Real Example from a Canadian Homeowner

"I was worried that taking out a reverse mortgage would eat away at my home’s value, but after five years, my house had appreciated at the same rate as my loan balance. I was able to cover my healthcare costs and still leave an inheritance for my kids." – Margaret P., 73, Toronto

Selling Too Soon Could Mean Losing Out on Growth

Many homeowners sell because they believe they need the money now. But selling too early can have long-term downsides:

Lost appreciation – If home prices rise, waiting a few more years could leave you with more equity to pass down to your family.

Unnecessary downsizing – Many retirees regret moving too soon when they could have stayed in their home longer.

Higher living costs – Renting or buying another property could end up being more expensive than staying put.

A reverse mortgage lets you stay in your home longer while accessing funds when you need them.

Long-Term Care Costs Are a Growing Concern

As Canadians age, the cost of healthcare and long-term care is a major financial challenge:

70% of Canadians over 65 will require some form of long-term care.

The average cost of a private long-term care home is $3,000–$5,000 per month.

In-home care services range from $20–$40 per hour, quickly adding up.

Many seniors sell their homes too soon to cover these expenses when they could have stayed in their home longer with the right financial solution.

How Rewind Mortgage Can Help

At Rewind Mortgage, we specialize in helping Canadians 55+ understand their home equity options—including reverse mortgages. Peter Fabry and his team take a personalized approach, ensuring that clients:

✔️ Fully understand the pros and cons of a reverse mortgage.

✔️ Compare it to other solutions, such as HELOCs or downsizing.

✔️ Make an informed decision that aligns with their long-term goals.

Reverse mortgages are not the right fit for everyone, but for the right situation, they can be a powerful financial tool.

FAQs About No-Payment Mortgages

Do I still own my home?

Yes! A reverse mortgage does not transfer ownership—you remain the homeowner, just like with any other mortgage.

What happens if home prices drop?

Most reverse mortgages in Canada include a no-negative-equity guarantee, meaning you’ll never owe more than your home is worth.

Can I still leave my home to my children?

Yes. Because home values tend to increase over time, many homeowners still have equity left to pass down to their heirs.

Is this my only option?

No! If you qualify for a traditional mortgage or a HELOC, those may be more cost-effective. A reverse mortgage is best suited for homeowners who don’t qualify for traditional financing but want to stay in their home.

How do I know if this is right for me?

Every situation is unique. If you’re considering a reverse mortgage, Rewind Mortgage can walk you through your options, side by side, so you can make an informed decision.

📞 Let’s talk! Call 289-312-6333 or email info@rewindmortgage.ca to explore your options.

Calculate What You Might Qualify For

What Our Customers are Saying About Us

Marcel L.

Grateful for Peter Fabry and all his help! It's been a lifesaver, supplementing our income and allowing us to travel during retirement. With the rising cost of living, Peter's guidance made the process easy and stress-free. Highly recommended!

Carole & Robert O.

Thanks to Peter Fabry, we upgraded our home with a reverse mortgage, avoiding the need for a care home. Peter's expertise and personalized approach made the process seamless. Highly recommended for seniors seeking financial freedom while aging in place!

James & Cynthia B.

We had an excellent experience working with Peter! He guided us through securing a Home Equity Line of Credit on our mortgage, which turned out to be a better fit for our financial goals. The process was stress-free, and we are relieved to have it sorted out. We highly recommend speaking with Peter for your mortgage needs!

Get In Touch

Address

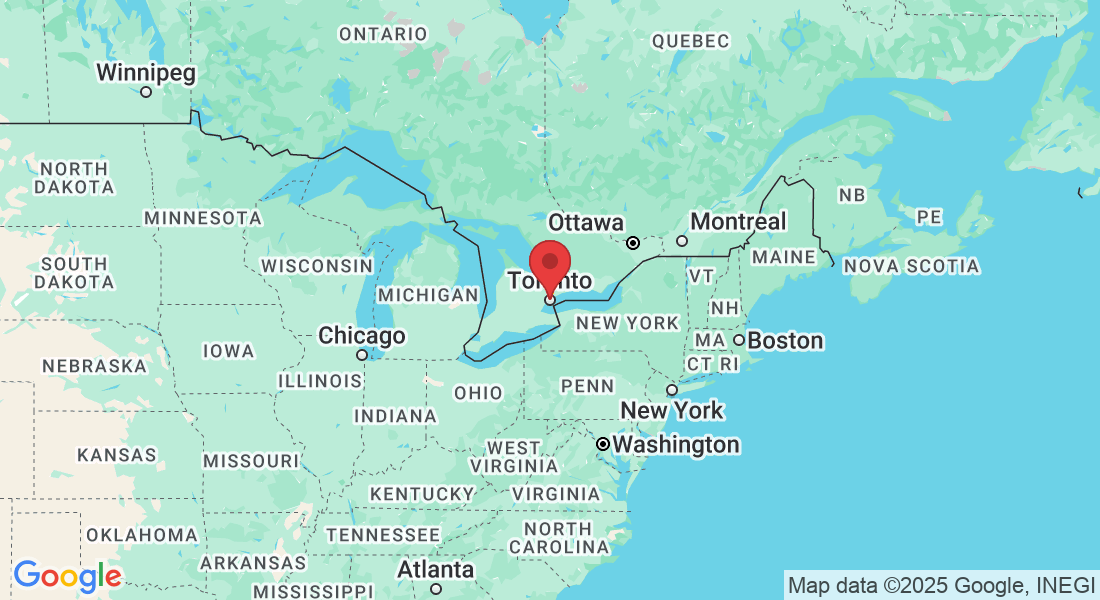

Office: Toronto, Ontario

Email: info@rewindmortgage.ca

Assistance Hours

Mon – Fri 9:00am – 6:00pm

Saturday – By Appointment Only

Sunday – CLOSED

Phone Number:

(289) 312-6333

Sit back, relax, and let us find the best product for you.

Discover the positive impact of reverse mortgages tailored for those who need financial support.

© 2025 Rewind Reverse Mortgages. All Rights Reserved.

.

Rewind Mortgage © All Rights Reserved. Brand, website & social media presence owned and managed by affiliated Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ (ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681) to inform & provide information specific to those 55+. This is an information website. Rewind is not a mortgage brokerage. For mortgage applications & advice you will speak with a licenced Agent/ Underwriter. Restrictions may apply. Subject to credit approval. By submitting your information you consent to us contacting you by text, email, or phone. For more details on how we handle and protect your data, please refer to our full

Privacy Policy

.