TM Brand and info. website and authorized name of Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681 www.brokerit.ca

Newsletters

Fixed or Variable—What If You Chose the Wrong One?

Many Canadians choose between a fixed or variable rate mortgage early in their homeownership journey and then wonder, years later, if they can (or should) change it. For homeowners aged 55+, this question often comes up as retirement approaches or financial needs shift.

Can you switch from a fixed rate to a variable, or vice versa? The short answer is yes—but it depends on where you are in your mortgage term and what you're hoping to achieve.

Rewind Mortgage helps clients make informed decisions at every stage of life, and switching mortgage types is a topic we regularly discuss with those nearing or in retirement.

Understanding Fixed and Variable Mortgages

First, let’s clarify the difference:

Fixed-rate mortgages offer consistent payments for a set number of years.

Variable-rate mortgages change based on the Bank of Canada’s overnight rate, which means your payments (or the interest portion) can change over time.

Many people lock in a fixed rate for peace of mind, while others choose variable hoping for long-term savings.

But when circumstances change—such as planning for retirement, managing monthly expenses, or reassessing investment strategies—it’s natural to wonder whether switching mortgage types makes sense.

What Happens If You Want to Switch?

Whether you're trying to lower your monthly costs or gain more payment flexibility, here’s how the process typically works.

Switching from Fixed to Variable

Changing from a fixed to a variable rate mid-term is less common, especially for retirees, because it requires breaking the existing mortgage.

This means:

You’ll pay a penalty, typically the greater of three months’ interest or something called the Interest Rate Differential (IRD), which can be a substantial amount

You’ll also be subject to current market rates—not the variable rate you were originally offered

The switch usually makes sense only if you're refinancing anyway, such as to access home equity or consolidate debt

If you stay with the same lender, they may offer a reduced penalty—but this isn’t guaranteed

Rewind Mortgage sees this type of switch most often when retirees are already planning to change their mortgage for other reasons—like transitioning to a Reverse Mortgage, downsizing, or eliminating monthly payments altogether.

Switching from Variable to Fixed

This option is more common and far simpler, especially in uncertain rate environments. Most variable-rate mortgage holders in Canada can lock into a fixed rate at any point during their term.

Here’s how it works:

You stay with your current lender, which means no penalty

You’re offered the lender’s current fixed rates, not the rate you could’ve locked in when you first signed

You’ll need to lock into a term equal to or longer than the time remaining on your mortgage

This option gained popularity during the sharp interest rate increases of 2022–2023, when many retirees and homeowners with variable rates chose to secure predictable payments. However, in today’s environment, with variable rates trending down, locking in may not be as appealing.

Common Misconception

A common misunderstanding is that you can lock into the original fixed rate offered when you started your mortgage. In reality, your lender will provide options based on today’s rates, and these rates can differ significantly from what was available a few years ago.

Should You Switch?

That depends on your current needs. Here are a few questions to consider:

Are you struggling with monthly payments on a fixed income?

Are you planning to access your home equity soon?

Do you want to avoid market volatility, or are you comfortable with some uncertainty?

At Rewind Mortgage, Peter Fabry works closely with clients to review their current mortgage, financial goals, and any penalties involved. The goal isn’t just to make a change—but to make the right one for long-term financial security.

A Note on Interest Rates in 2025

As of mid-2025, the Bank of Canada is expected to reduce rates further. This is encouraging for variable-rate holders, but it’s important to understand that fixed and variable rates are driven by different forces:

Variable rates respond to the Bank of Canada’s overnight rate (and influence prime rate)

Fixed rates are tied to the bond market, which can move independently due to inflation, economic uncertainty, or global political events—especially in the U.S.

This means fixed rates may not always follow variable rate trends, which is why rate decisions should be based on personal goals rather than headlines alone.

Not Sure Where to Start? Rewind Mortgage Can Help

If you’re 55+ and wondering whether it’s the right time to switch mortgage types—or if you’re exploring more flexible options like a Reverse Mortgage—Rewind Mortgage can help.

Peter Fabry and his team take the time to walk clients and their families through every scenario. Whether you're refinancing, downsizing, or looking for more retirement flexibility, we’ll help you understand your options clearly and without pressure.

Call 289-312-6333

Email info@rewindmortgage.ca

Let’s have a conversation that puts your long-term comfort and independence first.

Calculate What You Might Qualify For

What Our Customers are Saying About Us

Marcel L.

Grateful for Peter Fabry and all his help! It's been a lifesaver, supplementing our income and allowing us to travel during retirement. With the rising cost of living, Peter's guidance made the process easy and stress-free. Highly recommended!

Carole & Robert O.

Thanks to Peter Fabry, we upgraded our home with a reverse mortgage, avoiding the need for a care home. Peter's expertise and personalized approach made the process seamless. Highly recommended for seniors seeking financial freedom while aging in place!

James & Cynthia B.

We had an excellent experience working with Peter! He guided us through securing a Home Equity Line of Credit on our mortgage, which turned out to be a better fit for our financial goals. The process was stress-free, and we are relieved to have it sorted out. We highly recommend speaking with Peter for your mortgage needs!

Get In Touch

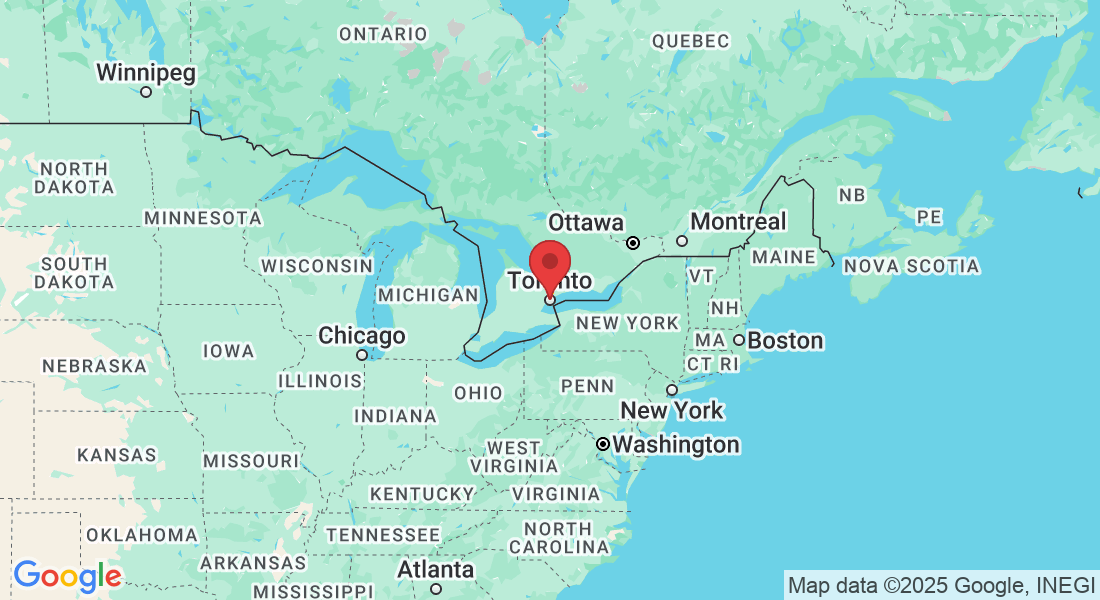

Address

Office: Toronto, Ontario

Email: info@rewindmortgage.ca

Assistance Hours

Mon – Fri 9:00am – 6:00pm

Saturday – By Appointment Only

Sunday – CLOSED

Phone Number:

(289) 312-6333

Sit back, relax, and let us find the best product for you.

Discover the positive impact of reverse mortgages tailored for those who need financial support.

For information on alternatives to reverse mortgages visit www.brokerit.ca

© 2025 Rewind Reverse Mortgages. All Rights Reserved.

.

Rewind Mortgage © All Rights Reserved. Brand, website & social media presence owned and managed by affiliated Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ (ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681) to inform & provide information specific to those 55+. This is an information website. Rewind is not a mortgage brokerage. For mortgage applications & advice you will speak with a licenced Agent/ Underwriter. Restrictions may apply. Subject to credit approval. By submitting your information you consent to us contacting you by text, email, or phone. For more details on how we handle and protect your data, please refer to our full

Privacy Policy

.