TM Brand and info. website and authorized name of Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681 www.brokerit.ca

Newsletters

Appraisals and Reverse Mortgages: What Retirees Need to Know About Home Valuations

Understanding When an Appraisal Is Required And Why It Matters

For Canadians aged 55 and over, exploring options like a Reverse Mortgage often comes with questions: Will my home need to be appraised? Who pays for it? And what happens if I don’t agree with the value?

At Rewind Mortgage, Peter Fabry and his team guide clients through these details with clarity and care. Whether you're downsizing, refinancing, or accessing home equity for retirement income, understanding how appraisals work in Canada can help you plan ahead with confidence.

What Is a Home Appraisal and Why Is It Needed?

A home appraisal is a formal evaluation of a property’s value conducted by a licensed professional. Lenders use appraisals to make sure they are not lending more than the home is worth.

In the case of a Reverse Mortgage, which allows Canadians 55+ to access up to 55% of their home’s value without monthly payments, confirming the property’s value is a key part of the approval process.

Why Appraisals Are Always Required for Reverse Mortgages

No matter where you apply in Canada, a full, independent home appraisal is always required when obtaining a Reverse Mortgage. This is because the amount you can access is directly tied to your home's fair market value, along with your age and property location.

An appraisal helps the lender determine:

The maximum loan amount available to you

Whether the property meets eligibility guidelines

A clear picture of the home’s condition and comparable sales

The appraisal must be completed before final approval. It’s an essential part of ensuring the Reverse Mortgage is a safe and suitable fit.

Who Pays for the Appraisal?

In most cases, the homeowner is responsible for covering the appraisal fee. The cost usually ranges between $300 and $800+, depending on the location, property size, and how quickly the report is needed.

Some lenders or brokers may offer limited-time promotions where the appraisal cost is waived or reimbursed at closing. However, unless specified in advance, it’s best to expect this as an upfront, non-refundable expense, even if you choose not to proceed.

At Rewind Mortgage, Peter Fabry ensures clients are fully informed of the costs involved before committing to any step.

What Happens During the Appraisal Process?

If you're applying for a Reverse Mortgage, refinancing, or helping a parent through this process, here’s what to expect:

The lender or broker arranges the appraisal, clients do not need to schedule it themselves.

The appraiser will contact the homeowner directly to book a visit.

During the visit, the appraiser will:

Take measurements and photos

Evaluate the condition of the property

Compare it to recent sales in the area

The final report is sent to the lender, not the client.

Even though the homeowner pays for the appraisal, the full report belongs to the lender. However, the client can typically be told the final valuation figure and whether the property met the required value range.

What If You Disagree with the Appraised Value?

Sometimes, the appraised value of a home comes in lower than expected. This can impact how much equity is available, especially in a Reverse Mortgage or refinance.

The good news is that Rewind Mortgage can often advocate on your behalf.

If the valuation seems low and there is solid evidence, such as recent comparable sales in your area, Peter Fabry can work with the lender to review the report or request a reassessment. While not every dispute results in a new valuation, it’s a process worth exploring when the numbers don’t seem to reflect the true market.

Private Sales Always Require an Appraisal

If you or a loved one is buying a home privately, without a listing agent involved, an appraisal is always required. This helps protect the lender and the buyer from overpaying and ensures the value can be independently verified.

When Might an Appraisal Not Be Required?

In very specific cases, such as when refinancing with very low loan amounts or high equity (often 35% or more), a lender may use something called an Automated Valuation Model (AVM).

This software estimates the value of the home based on local market data, without a physical visit. However, AVMs are not typically used for Reverse Mortgages or private purchases, where full appraisals are the standard.

Supporting You Through Every Step

Appraisals are a routine part of mortgage lending, but they can feel unfamiliar—especially if it’s your first time using home equity in retirement.

Rewind Mortgage works with Canadians 55+ and their families to ensure every step is clearly explained, from paperwork to property valuation. Whether you’re exploring a Reverse Mortgage or refinancing to access equity, Peter Fabry is here to help make the process transparent, supportive, and respectful of your goals.

Have questions about home equity, appraisals, or whether a Reverse Mortgage is right for you?

Connect with Rewind Mortgage today and schedule a no-pressure consultation with Peter Fabry.

📞 289-312-6333

📩 [email protected]

Rewind Mortgage is dedicated to seniors’ financial independence. Under Peter Fabry’s leadership, we blend empathetic service with creative mortgage solutions to help you enjoy life on your terms.

Calculate What You Might Qualify For

What Our Customers are Saying About Us

Marcel L.

Grateful for Peter Fabry and all his help! It's been a lifesaver, supplementing our income and allowing us to travel during retirement. With the rising cost of living, Peter's guidance made the process easy and stress-free. Highly recommended!

Carole & Robert O.

Thanks to Peter Fabry, we upgraded our home with a reverse mortgage, avoiding the need for a care home. Peter's expertise and personalized approach made the process seamless. Highly recommended for seniors seeking financial freedom while aging in place!

James & Cynthia B.

We had an excellent experience working with Peter! He guided us through securing a Home Equity Line of Credit on our mortgage, which turned out to be a better fit for our financial goals. The process was stress-free, and we are relieved to have it sorted out. We highly recommend speaking with Peter for your mortgage needs!

Get In Touch

Address

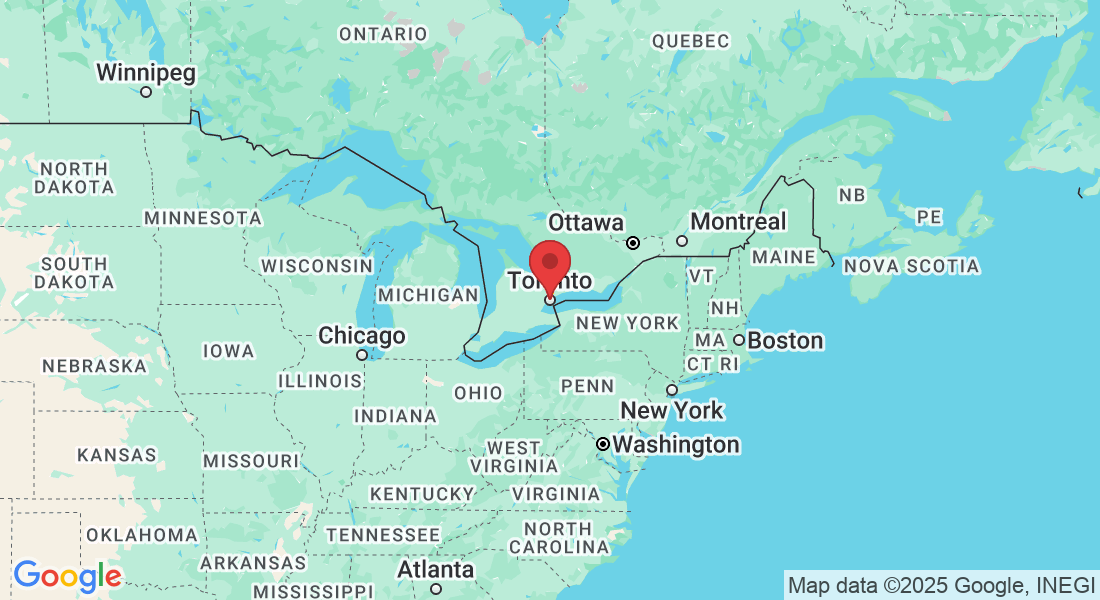

Office: Toronto, Ontario

Email: info@rewindmortgage.ca

Assistance Hours

Mon – Fri 9:00am – 6:00pm

Saturday – By Appointment Only

Sunday – CLOSED

Phone Number:

(289) 312-6333

Sit back, relax, and let us find the best product for you.

Discover the positive impact of reverse mortgages tailored for those who need financial support.

For information on alternatives to reverse mortgages visit www.brokerit.ca

© 2025 Rewind Reverse Mortgages. All Rights Reserved.

.

Rewind Mortgage © All Rights Reserved. Brand, website & social media presence owned and managed by affiliated Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ (ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681) to inform & provide information specific to those 55+. This is an information website. Rewind is not a mortgage brokerage. For mortgage applications & advice you will speak with a licenced Agent/ Underwriter. Restrictions may apply. Subject to credit approval. By submitting your information you consent to us contacting you by text, email, or phone. For more details on how we handle and protect your data, please refer to our full

Privacy Policy

.