TM Brand and info. website and authorized name of Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681 www.brokerit.ca

Newsletters

5 Essential Questions Retirees Should Ask Rewind Mortgage

Accessing home equity in retirement can feel overwhelming. Rewind Mortgage, led by Peter Fabry, helps Canadians aged 55 and up tap into their home’s value while retaining ownership. Before you proceed, here are five critical questions every retiree—and their family—should discuss with Rewind Mortgage.

1. How Does a Reverse Mortgage Affect Ownership and Equity?

Many worry a reverse mortgage means giving up their home. That’s not the case with Rewind Mortgage.

What You Need to Know

Full ownership remains – Borrowers keep their title and the right to live in the home.

Interest compounding vs. home-value growth – Interest accrues on your loan balance, but historically Canadian home values have risen faster than interest costs.

Repayment triggers – The loan becomes due only when the last borrower moves out permanently or the property is sold.

Peter Fabry emphasizes that a reverse mortgage is a financing tool, not a sale. It converts a portion of your equity into cash while you stay in your home.

2. What Are All the Fees and Charges?

Hidden costs can erode the benefits if you’re not prepared. Rewind Mortgage provides full transparency with a written fee schedule.

Peter Fabry reviews each fee line by line so you understand exactly what you’ll pay—and when.

3. Will My Government Benefits or Taxes Be Impacted?

Seniors often depend on CPP, OAS, and GIS, so it’s crucial to know how a reverse mortgage interacts with these programs.

What You Need to Know

Not treated as income – Loan proceeds are advances on equity, not taxable income, so benefits eligibility is generally unaffected.

No immediate tax deductions – Interest isn’t deductible until you make payments, which only occur at loan maturity.

Estate considerations – The outstanding balance reduces your home’s net equity, which impacts what heirs inherit.

Rewind Mortgage works closely with your accountant or tax advisor to map out long-term effects on your estate and benefits.

4. What Withdrawal Options Match My Needs?

Different lifestyles call for different cash-out strategies. Rewind Mortgage offers two flexible formats.

Peter Fabry customizes your withdrawal plan so you borrow only what you need when you need it—and avoid unnecessary interest.

5. How Are My Family Members Included?

Reverse mortgages carry emotional weight for everyone involved. Engaging your family early ensures transparency and peace of mind.

What You Need to Know

Joint borrowers – Spouses or common-law partners can both be named, preserving access regardless of who holds title.

Family consultations – Peter Fabry welcomes meetings with adult children, trustees or executors to explain terms, answer questions and align expectations.

Estate planning integration – Rewind Mortgage coordinates with your lawyer and financial planner to weave the reverse mortgage into wills, powers of attorney and long-term care plans.

Including loved ones from the outset helps avoid surprises and ensures everyone understands how the reverse mortgage supports your retirement goals.

Take the Next Step with Confidence

A reverse mortgage from Rewind Mortgage can be a powerful way to access home equity without monthly payments—but only if you ask the right questions first. Peter Fabry’s empathetic, client-first approach ensures you and your family fully understand the costs, benefits and long-term implications.

Ready to explore whether a reverse mortgage is right for your retirement plan? Visit rewindmortgage.ca, call 289-312-6333 or email info@rewindmortgage.ca. Let Rewind Mortgage help you access the equity you’ve built, retain ownership and secure a more comfortable retirement.

Calculate What You Might Qualify For

What Our Customers are Saying About Us

Marcel L.

Grateful for Peter Fabry and all his help! It's been a lifesaver, supplementing our income and allowing us to travel during retirement. With the rising cost of living, Peter's guidance made the process easy and stress-free. Highly recommended!

Carole & Robert O.

Thanks to Peter Fabry, we upgraded our home with a reverse mortgage, avoiding the need for a care home. Peter's expertise and personalized approach made the process seamless. Highly recommended for seniors seeking financial freedom while aging in place!

James & Cynthia B.

We had an excellent experience working with Peter! He guided us through securing a Home Equity Line of Credit on our mortgage, which turned out to be a better fit for our financial goals. The process was stress-free, and we are relieved to have it sorted out. We highly recommend speaking with Peter for your mortgage needs!

Get In Touch

Address

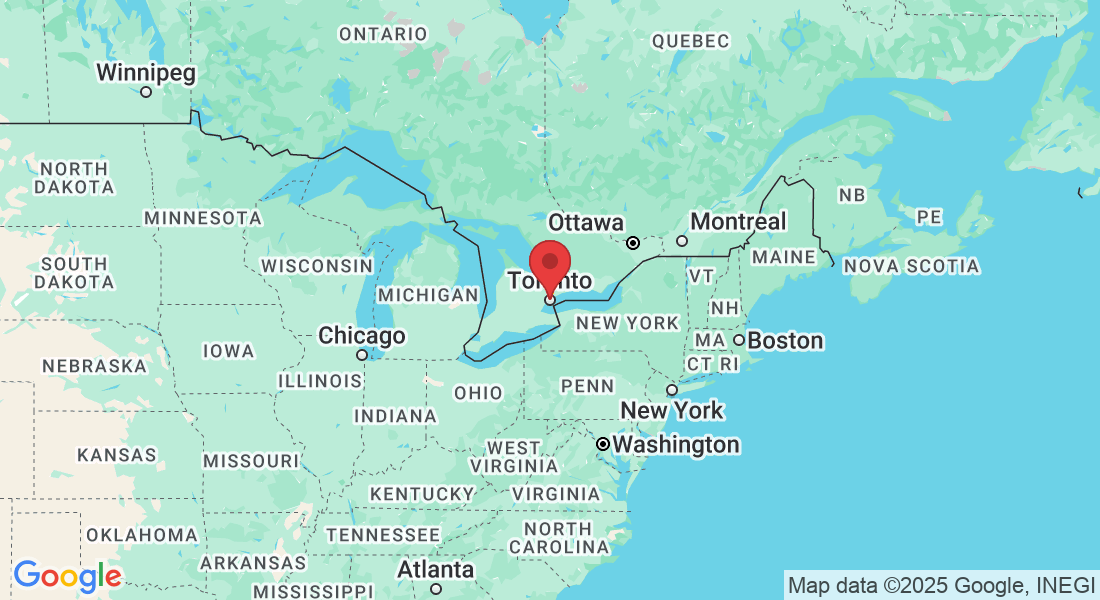

Office: Toronto, Ontario

Email: info@rewindmortgage.ca

Assistance Hours

Mon – Fri 9:00am – 6:00pm

Saturday – By Appointment Only

Sunday – CLOSED

Phone Number:

(289) 312-6333

Sit back, relax, and let us find the best product for you.

Discover the positive impact of reverse mortgages tailored for those who need financial support.

For information on alternatives to reverse mortgages visit www.brokerit.ca

© 2025 Rewind Reverse Mortgages. All Rights Reserved.

.

Rewind Mortgage © All Rights Reserved. Brand, website & social media presence owned and managed by affiliated Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ (ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681) to inform & provide information specific to those 55+. This is an information website. Rewind is not a mortgage brokerage. For mortgage applications & advice you will speak with a licenced Agent/ Underwriter. Restrictions may apply. Subject to credit approval. By submitting your information you consent to us contacting you by text, email, or phone. For more details on how we handle and protect your data, please refer to our full

Privacy Policy

.