TM Brand and info. website and authorized name of Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681 www.brokerit.ca

Newsletters

Choosing the Right Mortgage Strategy in 2026 for Canadian Retirees

Mortgage decisions after 55 require a different strategy. Whether you are restructuring debt, supporting adult children, improving cash flow, or considering a Reverse Mortgage, choosing between fixed,... ...more

Mortgages ,Broker Blogs &Reverse Mortgage

February 15, 2026•3 min read

New Video: If Not the Middle Class, Then Where? Rethinking Canada’s Revenue Problem

Canada needs revenue, and Canadians want public services. But continually increasing middle-class tax pressure isn’t sustainable. In this video, Peter Fabry explores a practical question many Canadia... ...more

Reverse Mortgage

February 07, 2026•undefined

New Video: Is This How Canada's Largest Firms Dodge Billions in Taxes?

When Canadians see record corporate profits, a fair question comes up: If revenue is earned in Canada, why does taxable income sometimes show up somewhere else? This video isn’t about blaming compani... ...more

Reverse Mortgage

February 03, 2026•undefined

Rising Buyer Demand in Canada’s 2026 Housing Market

With buyer demand increasing in Canada’s 2026 housing market, homeowners aged 55+ may have more options when it comes to selling, downsizing, or accessing home equity. Here’s how current market trends... ...more

Mortgages ,Broker Blogs &Reverse Mortgage

February 02, 2026•2 min read

New Video: The REAL Reason Canadians Pay So Much in Taxes

Ever looked at your tax bill and thought, “Who decided this… and why?” In this video, Peter Fabry breaks down where Canada’s major taxes actually came from; Property tax, sales tax, GST, HST, and inc... ...more

Reverse Mortgage

January 30, 2026•undefined

New Video: Retirement Home Regrets: The Reality Nobody Expects

He bought his “dream retirement home.” It became the biggest mistake of his retirement. In this video, Peter Fabry shares the real story of Tom, a careful, hardworking Canadian who spent his savings ... ...more

Reverse Mortgage

January 27, 2026•undefined

Calculate What You Might Qualify For

What Our Customers are Saying About Us

Marcel L.

Grateful for Peter Fabry and all his help! It's been a lifesaver, supplementing our income and allowing us to travel during retirement. With the rising cost of living, Peter's guidance made the process easy and stress-free. Highly recommended!

Carole & Robert O.

Thanks to Peter Fabry, we upgraded our home with a reverse mortgage, avoiding the need for a care home. Peter's expertise and personalized approach made the process seamless. Highly recommended for seniors seeking financial freedom while aging in place!

James & Cynthia B.

We had an excellent experience working with Peter! He guided us through securing a Home Equity Line of Credit on our mortgage, which turned out to be a better fit for our financial goals. The process was stress-free, and we are relieved to have it sorted out. We highly recommend speaking with Peter for your mortgage needs!

Get In Touch

Address

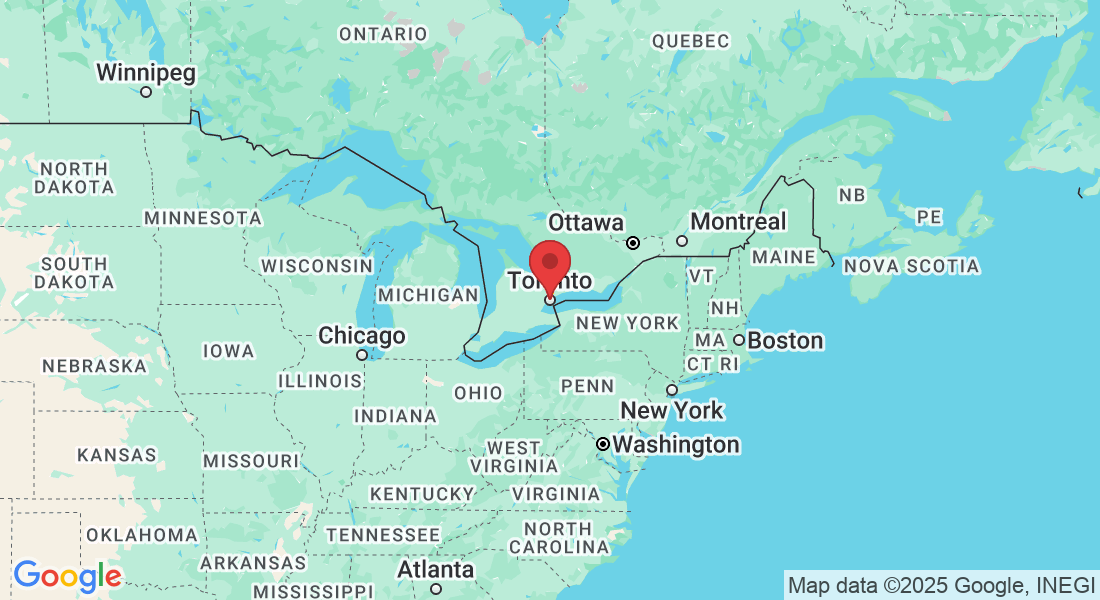

Office: Toronto, Ontario

Email: info@rewindmortgage.ca

Assistance Hours

Mon – Fri 9:00am – 6:00pm

Saturday – By Appointment Only

Sunday – CLOSED

Phone Number:

(289) 312-6333

Sit back, relax, and let us find the best product for you.

Discover the positive impact of reverse mortgages tailored for those who need financial support.

For information on alternatives to reverse mortgages visit www.brokerit.ca

© 2026 Rewind Reverse Mortgages. All Rights Reserved.

.

Rewind Mortgage © All Rights Reserved. Brand, website & social media presence owned and managed by affiliated Lic. Mortgage Brokerage 11082191 Canada Inc.o/a ‘Broker It’ (ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681) to inform & provide information specific to those 55+. This is an information website. Rewind is not a mortgage brokerage. For mortgage applications & advice you will speak with a licenced Agent/ Underwriter. Restrictions may apply. Subject to credit approval. By submitting your information you consent to us contacting you by text, email, or phone. For more details on how we handle and protect your data, please refer to our full

Privacy Policy

.